Unemployment Insurance: A Lifeline During Economic Turmoil

In the modern world, where economic stability is often precarious, the fear of unemployment looms large for many individuals and families. Whether due to technological advancements, industry shifts, or global crises, the threat of job loss is a persistent concern. To mitigate the financial hardships associated with unemployment, governments and private institutions offer unemployment insurance—a safety net designed to provide temporary financial assistance to individuals who find themselves without work. In this extensive exploration, we delve into the intricacies of unemployment insurance, examining its importance, implementation, benefits, and challenges.

Understanding Unemployment Insurance

Unemployment insurance, also known as unemployment benefits or jobless benefits, is a government-sponsored program that offers financial assistance to eligible individuals who have lost their jobs involuntarily. The primary objective of unemployment insurance is to provide temporary income support to help unemployed workers meet their basic needs while they search for new employment opportunities.

The structure of unemployment insurance programs varies from country to country, but they typically operate based on the following principles:

- Eligibility Criteria: To qualify for unemployment benefits, individuals must meet specific eligibility requirements established by the governing authority. These requirements often include having a recent work history, being actively seeking employment, and meeting minimum earnings thresholds.

- Benefit Calculation: The amount of unemployment benefits an individual receives is determined based on their earnings history and the regulations of the unemployment insurance program. Benefits are typically calculated as a percentage of the individual’s previous wages, up to a predetermined maximum amount.

- Duration of Benefits: Unemployment benefits are provided for a limited period, known as the benefit duration. The duration of benefits varies depending on factors such as the individual’s work history, the prevailing unemployment rate, and the policies of the unemployment insurance program.

- Job Search Requirements: To continue receiving unemployment benefits, individuals are often required to actively search for work and document their job search activities. This requirement ensures that beneficiaries are making a genuine effort to re-enter the workforce.

- Funding Mechanism: Unemployment insurance programs are funded through various mechanisms, including payroll taxes paid by employers, government contributions, and in some cases, employee contributions. The funds collected are used to finance the payment of unemployment benefits to eligible recipients.

Benefits of Unemployment Insurance

Unemployment insurance serves as a critical lifeline for individuals and families facing job loss, offering a range of benefits that contribute to financial stability and economic security:

- Income Replacement: Perhaps the most immediate benefit of unemployment insurance is the provision of income replacement to unemployed individuals. By replacing a portion of lost wages, unemployment benefits help individuals cover essential expenses such as housing, food, and utilities during periods of unemployment.

- Stabilizing the Economy: Unemployment insurance plays a vital role in stabilizing the economy during times of economic downturn. By providing financial assistance to unemployed workers, unemployment benefits help maintain consumer spending levels, thereby supporting businesses and preventing further economic contraction.

- Facilitating Job Search: Unemployment benefits enable individuals to focus on finding suitable employment opportunities without experiencing immediate financial distress. This financial support reduces the pressure to accept low-paying or unsuitable jobs out of desperation, allowing individuals to seek positions that align with their skills and qualifications.

- Reducing Poverty and Social Inequality: Unemployment insurance helps prevent individuals and families from falling into poverty as a result of job loss. By providing a financial safety net, unemployment benefits mitigate the adverse effects of unemployment on household income and reduce social inequality within society.

- Promoting Social Stability: Access to unemployment insurance promotes social stability by reducing the likelihood of social unrest and upheaval caused by widespread unemployment. By alleviating financial hardships and maintaining social cohesion, unemployment benefits contribute to a more resilient and cohesive society.

Challenges and Considerations

Despite its many benefits, unemployment insurance also faces certain challenges and considerations that warrant attention:

- Funding Sustainability: Ensuring the long-term sustainability of unemployment insurance programs requires careful management of funding sources and resources. Economic fluctuations, demographic changes, and evolving labor market dynamics can impact the financial viability of these programs, necessitating periodic review and adjustments.

- Administrative Efficiency: The administration of unemployment insurance programs involves complex processes for determining eligibility, processing claims, and disbursing benefits. Efficient and effective administration is essential to minimize bureaucratic delays and ensure timely support for unemployed individuals.

- Fraud and Abuse: Unemployment insurance programs are vulnerable to fraudulent activities such as false claims, identity theft, and benefit misuse. Implementing robust fraud detection measures and enforcement mechanisms is critical to safeguarding the integrity of these programs and preserving public trust.

- Labor Market Dynamics: The design and implementation of unemployment insurance programs must adapt to changing labor market dynamics, including shifts in employment patterns, technological advancements, and globalization. Flexibility and responsiveness are essential to address emerging challenges and support workers in a rapidly evolving economy.

- Equitable Access: Ensuring equitable access to unemployment insurance benefits is paramount to prevent disparities based on factors such as race, gender, age, or socioeconomic status. Outreach efforts, language accessibility, and targeted assistance programs can help address barriers to access and promote inclusivity within the unemployment insurance system.

Unemployment insurance serves as a vital safety net for individuals and families grappling with the financial consequences of job loss. By providing temporary income support, stabilizing the economy, and promoting social stability, unemployment benefits play a crucial role in mitigating the adverse effects of unemployment on individuals, communities, and society as a whole. However, addressing the challenges associated with unemployment insurance requires ongoing collaboration, innovation, and policy adaptation to ensure that these programs remain effective, efficient, and equitable in an ever-changing economic landscape.

Unemployment, whether caused by economic downturns, technological advancements, or personal circumstances, poses significant financial challenges for individuals and families. In response to this pervasive risk, governments and private insurers offer unemployment insurance as a safety net to help mitigate the financial impact of job loss. This comprehensive analysis explores the intricacies of unemployment insurance, its purpose, types, eligibility criteria, benefits, challenges, and the evolving landscape of unemployment protection in today’s dynamic economy.

Understanding Unemployment Insurance:

Unemployment insurance, also known as unemployment compensation or benefits, is a social welfare program designed to provide temporary financial assistance to eligible individuals who have lost their jobs through no fault of their own. The primary goal of unemployment insurance is to replace a portion of lost income and help unemployed workers meet their basic needs while actively seeking reemployment.

Purpose of Unemployment Insurance:

The significance of unemployment insurance extends beyond immediate financial support. Some key purposes include:

- Financial Stability: Unemployment insurance helps cushion the financial blow of job loss by providing a source of income to cover essential expenses such as housing, food, and utilities. This financial stability is crucial for maintaining a basic standard of living during periods of unemployment.

- Economic Stimulus: By injecting funds into the economy, unemployment insurance can help stimulate consumer spending and support local businesses. When unemployed individuals receive benefits, they are more likely to spend money on goods and services, thereby contributing to economic growth and stability.

- Social Protection: Unemployment insurance serves as a safety net for vulnerable individuals and families facing sudden or prolonged unemployment. It helps prevent poverty, homelessness, and other social ills that can result from prolonged periods without steady income.

Types of Unemployment Insurance:

Unemployment insurance programs can vary significantly across countries and jurisdictions, but they generally fall into two main categories:

- Government-Run Programs: In many countries, unemployment insurance is administered by government agencies at the national or state level. These programs are funded through payroll taxes levied on employers and, in some cases, employees. Government-run unemployment insurance typically offers standardized benefits and eligibility criteria set by law.

- Private Unemployment Insurance: Some individuals may opt for private unemployment insurance offered by insurance companies or financial institutions. Private unemployment insurance policies often provide more flexibility and customization options, allowing policyholders to tailor coverage to their specific needs. However, these policies may come with higher premiums and stricter eligibility requirements.

Eligibility Criteria for Unemployment Insurance:

While eligibility criteria can vary depending on the jurisdiction and program, common requirements for unemployment insurance typically include:

- Work History: Applicants must have a sufficient work history, typically measured by the number of hours worked or quarters of employment, during a specified base period preceding the job loss.

- Job Separation: Individuals must have lost their job through no fault of their own, such as layoffs, company closures, or reductions in workforce. Those who voluntarily resign or are terminated for misconduct may not be eligible for benefits.

- Availability and Actively Seeking Work: To qualify for unemployment insurance, individuals must be able and available to work and actively seeking employment. This requirement often involves registering with a state employment agency, submitting job applications, and participating in job search activities.

Benefits of Unemployment Insurance:

Unemployment insurance provides a range of benefits to both individuals and society as a whole. Some key advantages include:

- Income Replacement: Unemployment insurance helps replace a portion of lost income, providing a financial lifeline to unemployed workers and their families during periods of job loss.

- Temporary Support: While unemployment insurance benefits are temporary, they offer critical support during the transition between jobs, helping individuals cover basic living expenses until they can secure new employment.

- Job Search Assistance: Many unemployment insurance programs offer job search assistance and career counseling services to help unemployed individuals find new job opportunities, update their skills, and navigate the job market effectively.

Challenges and Criticisms of Unemployment Insurance:

Despite its many benefits, unemployment insurance is not without its challenges and criticisms. Some common concerns include:

- Adequacy of Benefits: In some cases, unemployment insurance benefits may not fully replace lost income or may be insufficient to meet the needs of unemployed workers, particularly those with dependents or high living expenses.

- Duration of Benefits: The duration of unemployment insurance benefits is typically limited, with most programs offering benefits for a set number of weeks or months. Long-term unemployed individuals may exhaust their benefits before finding new employment, leaving them vulnerable to financial hardship.

- Moral Hazard: Critics of unemployment insurance argue that generous benefits may disincentivize individuals from actively seeking work or accepting available job opportunities. This phenomenon, known as moral hazard, can lead to prolonged unemployment and dependency on government assistance.

The Evolving Landscape of Unemployment Protection:

In recent years, the landscape of unemployment protection has undergone significant changes in response to shifting economic realities and societal trends. Some notable developments include:

- Gig Economy Challenges: The rise of the gig economy and non-traditional forms of employment has posed challenges for traditional unemployment insurance programs, which are often designed around the concept of full-time, salaried employment. As more individuals engage in freelance, contract, or temporary work, policymakers are grappling with how to extend unemployment protections to workers in these sectors.

- Automation and Technological Displacement: Advances in automation and artificial intelligence have raised concerns about the potential for widespread job displacement and unemployment in certain industries. As jobs become increasingly automated, policymakers are exploring new approaches to unemployment protection, such as retraining programs, job placement services, and universal basic income initiatives.

- Pandemic Response: highlighted the importance of robust unemployment insurance systems in providing support to workers during times of crisis. Many governments implemented emergency measures to expand unemployment benefits, extend eligibility criteria, and bolster unemployment assistance programs in response to the economic fallout from the pandemic.

In an ever-changing economic landscape, the risk of unemployment looms over many individuals and families. Whether due to layoffs, company closures, or economic downturns, the loss of a job can have significant financial implications, leading to stress, uncertainty, and hardship. In response to this challenge, governments and private insurers offer unemployment insurance as a safety net to protect workers from the financial consequences of involuntary job loss. In this comprehensive guide, we will explore the concept, purpose, benefits, and considerations of unemployment insurance, shedding light on its importance in safeguarding financial stability during times of unemployment.

Understanding Unemployment Insurance

Unemployment insurance, also known as unemployment compensation or job loss insurance, is a social welfare program designed to provide temporary financial assistance to eligible individuals who have lost their jobs through no fault of their own. The primary objective of unemployment insurance is to help unemployed workers meet their basic needs, such as food, housing, and utilities, while they search for new employment opportunities.

Features of Unemployment Insurance

Unemployment insurance programs typically possess the following key features:

- Temporary Income Replacement: Unemployment insurance provides eligible individuals with a percentage of their previous earnings as temporary income replacement during periods of unemployment. The amount and duration of benefits vary depending on factors such as state regulations, employment history, and earnings.

- Qualification Criteria: To qualify for unemployment insurance benefits, individuals must meet specific eligibility criteria established by the governing authorities. These criteria commonly include having a recent work history, being available and actively seeking employment, and meeting minimum earnings requirements.

- Employer Contributions: In many countries, funding for unemployment insurance comes from contributions made by employers on behalf of their employees. Employers are typically required to pay unemployment taxes or premiums to finance the program, which is then used to fund benefit payments to eligible claimants.

- Waiting Period and Benefit Duration: Unemployment insurance often includes a waiting period, known as the “waiting week,” during which eligible individuals must wait before receiving benefits. Additionally, benefits are typically provided for a limited duration, such as a certain number of weeks or until the recipient finds new employment, whichever comes first.

- Job Search Requirements: Recipients of unemployment insurance benefits are usually required to actively search for new employment opportunities and report their job search activities to the relevant authorities. Failure to comply with job search requirements may result in the suspension or termination of benefits.

Benefits of Unemployment Insurance

Unemployment insurance offers several benefits to both individuals and society as a whole:

- Financial Security: Unemployment insurance provides a vital source of income for individuals who have lost their jobs, helping them maintain financial stability and meet their basic needs during periods of unemployment. This financial assistance reduces the risk of homelessness, poverty, and financial distress among affected workers and their families.

- Economic Stimulus: By injecting funds into the hands of unemployed individuals, unemployment insurance helps stimulate economic activity and consumer spending. This, in turn, supports local businesses and industries, creating a ripple effect that contributes to overall economic growth and stability.

- Preservation of Workforce Skills: Unemployment insurance enables workers to take the time necessary to search for suitable employment opportunities that match their skills, qualifications, and career goals. This ensures a better fit between workers and available jobs, leading to higher productivity, job satisfaction, and long-term employment stability.

- Social Cohesion: Unemployment insurance promotes social cohesion and solidarity by demonstrating a commitment to supporting individuals during times of need. By providing a safety net for the unemployed, society sends a message of compassion, empathy, and mutual assistance, strengthening social bonds and fostering a sense of community resilience.

- Reduced Reliance on Public Assistance: By providing temporary financial assistance to unemployed individuals, unemployment insurance reduces the burden on public assistance programs and social welfare services. This frees up resources that can be allocated to other priority areas, such as education, healthcare, and infrastructure development.

Types of Unemployment Insurance

Unemployment insurance programs can vary significantly from one country to another in terms of coverage, eligibility criteria, benefit levels, and administration. Some common types of unemployment insurance include:

- State Unemployment Insurance: In many countries, including the United States, unemployment insurance is administered at the state level, with each state operating its own unemployment insurance program. State unemployment insurance programs are funded through employer payroll taxes and provide benefits to eligible unemployed workers based on state-specific regulations.

- Federal Unemployment Insurance: In addition to state-level programs, some countries have federal unemployment insurance schemes that provide supplemental benefits or assistance to unemployed individuals during times of national economic crisis or emergency. Federal unemployment insurance may offer extended benefits, additional financial support, or special provisions to address unique circumstances.

- Private Unemployment Insurance: Private insurers also offer unemployment insurance policies to individuals and employers as a supplement or alternative to government-run programs. Private unemployment insurance policies may offer more extensive coverage, higher benefit levels, and additional services such as job placement assistance or career counseling.

Considerations When Applying for Unemployment Insurance

Before applying for unemployment insurance benefits, individuals should consider the following factors:

- Eligibility Requirements: Familiarize yourself with the eligibility criteria for unemployment insurance in your jurisdiction, including requirements related to employment history, earnings, availability for work, and reasons for job separation.

- Application Process: Understand the application process for unemployment insurance benefits, including the required documentation, forms, and information you need to provide. Follow the instructions provided by the relevant authorities and submit your application within the specified timeframe to avoid delays or complications.

- Benefit Calculation: Learn how unemployment insurance benefits are calculated in your jurisdiction, including the formula used to determine the amount of benefits based on your previous earnings and employment history. Use online calculators or contact the unemployment office for assistance if you need help estimating your potential benefit amount.

Unemployment is a harsh reality that many individuals face at some point in their lives. Whether due to economic downturns, technological advancements, or personal circumstances, losing a job can have profound financial implications. Unemployment insurance serves as a vital resource, providing financial assistance to individuals who find themselves without work, offering a lifeline as they navigate the challenges of job loss and seek new employment opportunities.

Understanding Unemployment Insurance:

Unemployment insurance, also known as job loss insurance or involuntary loss of income insurance, is a government-backed program designed to provide temporary financial assistance to eligible individuals who are unemployed through no fault of their own. The primary objective of unemployment insurance is to replace a portion of lost wages and help unemployed workers meet their basic living expenses while they actively search for new employment.

How Unemployment Insurance Works:

Unemployment insurance operates through a combination of employer contributions and government funding. Employers are typically required to pay unemployment insurance taxes, which are used to fund the program. When an employee becomes unemployed, they may file a claim for unemployment benefits through their state’s unemployment insurance agency. To qualify for benefits, individuals must meet certain eligibility criteria, such as having a recent work history, actively seeking employment, and being available to work.

Once a claim is approved, the unemployed individual receives weekly or biweekly benefit payments for a specified period, known as the benefit duration. The amount of benefits received is typically based on the individual’s earnings prior to unemployment, with payments intended to partially replace lost wages. Benefit amounts and duration may vary depending on factors such as state regulations, earnings history, and reason for unemployment.

Types of Unemployment Insurance Programs:

- State Unemployment Insurance:

State unemployment insurance programs are administered at the state level and vary in terms of eligibility criteria, benefit amounts, and duration. Each state sets its own guidelines for unemployment insurance, including the maximum benefit amount, weekly benefit cap, and duration of benefits. Eligibility requirements typically include having a minimum amount of prior earnings, being unemployed through no fault of one’s own, and actively seeking employment.

- Federal Unemployment Insurance Extensions:

During times of economic hardship or high unemployment rates, the federal government may implement extensions or expansions of unemployment insurance benefits. These extensions provide additional weeks of benefits beyond the standard state-provided duration, offering support to unemployed individuals facing prolonged job searches or difficulty finding new employment opportunities.

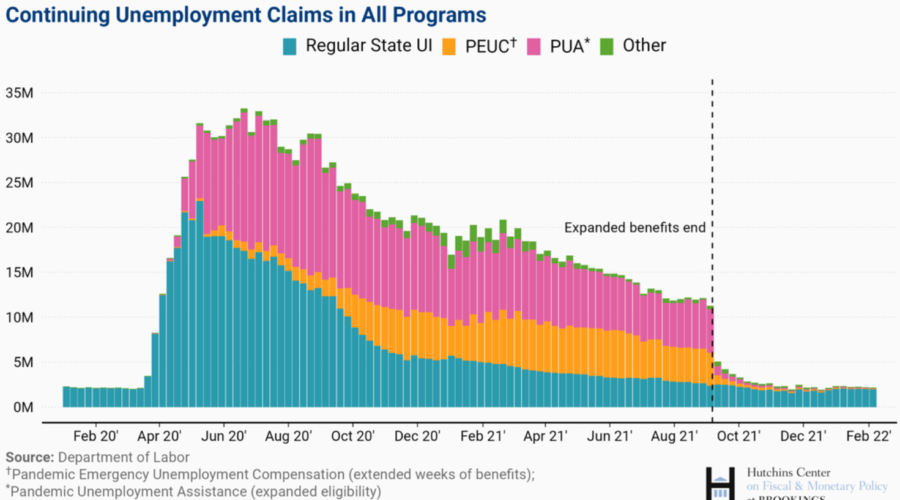

- Pandemic Unemployment Assistance (PUA):

In response to the COVID-19 pandemic, the U.S. government introduced the Pandemic Unemployment Assistance (PUA) program to provide financial assistance to workers who are not traditionally eligible for state unemployment benefits. This includes self-employed individuals, independent contractors, gig workers, and others who may not qualify for regular unemployment insurance. PUA benefits are funded by the federal government and administered by state unemployment agencies.

Benefits of Unemployment Insurance:

- Financial Security:

Unemployment insurance provides a crucial safety net for individuals and families facing job loss, helping to mitigate the financial impact of unemployment and prevent economic hardship. By replacing a portion of lost wages, unemployment benefits enable unemployed workers to cover essential living expenses such as housing, food, utilities, and healthcare while they actively search for new employment opportunities.

- Support During Job Transition:

Losing a job can be a stressful and uncertain time, but unemployment insurance provides a measure of stability and support during the job transition process. By offering financial assistance, unemployment benefits allow individuals to focus on finding suitable employment without the immediate pressure of financial distress, reducing anxiety and facilitating a smoother transition back into the workforce.

- Economic Stimulus:

Unemployment insurance not only supports individual households but also contributes to overall economic stability and growth. By providing financial assistance to unemployed workers, unemployment benefits help maintain consumer spending levels, support local businesses, and stimulate economic activity. This can have positive ripple effects throughout the economy, helping to mitigate the broader impact of job loss on communities and industries.

Challenges and Considerations:

While unemployment insurance offers valuable support to unemployed individuals, there are certain challenges and considerations to keep in mind:

- Funding and Sustainability:

Unemployment insurance programs rely on a combination of employer contributions and government funding to sustain operations and pay benefits. During periods of high unemployment or economic downturns, funding challenges may arise, leading to concerns about the long-term sustainability of the program and the adequacy of benefit levels.

- Administrative Burden:

The process of applying for and receiving unemployment benefits can be complex and time-consuming, requiring individuals to navigate bureaucratic procedures, submit documentation, and meet eligibility requirements. Delays in processing claims or disputes over eligibility can add to the administrative burden and frustration for unemployed workers seeking assistance.

- Disincentive to Work:

Critics of unemployment insurance argue that generous benefit levels and extended durations may create disincentives for unemployed individuals to actively seek employment. Concerns have been raised about the potential for unemployment benefits to prolong job searches or discourage individuals from accepting available job opportunities, particularly if the offered wages are lower than the benefits received.

- Addressing Structural Unemployment:

Unemployment insurance primarily addresses temporary job loss due to economic factors or individual circumstances. However, structural unemployment, resulting from mismatches between available jobs and the skills or qualifications of the workforce, presents a more complex challenge. Addressing structural unemployment requires broader policy interventions, such as workforce training programs, education initiatives, and targeted job creation efforts.

Conclusion:

Unemployment insurance plays a critical role in supporting individuals and families during periods of job loss and economic uncertainty. By providing temporary financial assistance, unemployment benefits help unemployed workers meet their basic living expenses while they actively search for new employment opportunities. As a key component of the social safety net, unemployment insurance promotes financial stability, economic resilience, and social welfare, ensuring that individuals can weather the challenges of unemployment and transition successfully back into the workforce.

Leave a Reply